Economic Outlook for the 24/25 Financial Year

-

Agriculture

-

All Agriculture

Select sub classifications-

Agricultural Technician

-

Fisheries Officer

-

Meat Inspector

-

Quarantine Officer

-

Primary Products Inspector Nec

-

Aquaculture Farmer

-

Cotton Grower

-

Flower Grower

-

Fruit or Nut Grower

-

Grain, Oilseed or Pasture Grower

-

Grape Grower

-

Mixed Crop Farmer

-

Sugar Cane Grower

-

Turf Grower

-

Vegetable Grower

-

Crop Farmers nec

-

Apiarist

-

Beef Cattle Farmer

-

Dairy Cattle Farmer

-

Deer Farmer

-

Goat Farmer

-

Horse Breeder

-

Mixed Livestock Farmer

-

Pig Farmer

-

Poultry Farmer

-

Sheep Farmer

-

Livestock Farmer nec

-

Mixed Crop and Livestock Farmer

-

Hunter Trapper

-

Pest Controller

-

Farm, Forestry and Garden Workers Nec

-

Wine Maker

-

Food Technologist

-

Agricultural Engineer

-

Agriculture Consultant

-

Forester

-

Biomedical Engineer

-

Production Manager (Forestry)

-

Shearer

-

Veterinary Nurse

-

Wool Buyer

-

Florist

-

Gardener (General)

-

Arborist

-

Landscape Gardener

-

Greenkeeper

-

Nurseryperson

-

Dog Trainer or Handler

-

Horse Trainer

-

Pet Groomer

-

Zookeeper

-

Animal Attendants and Trainers (nec)

-

Agricultural and Horticultural Mobile Plant Operator

-

Logging Plant Operator

-

Conservation Officer

-

Environmental Consultant

-

Environmental Research Scientist

-

Park Ranger

-

Environmental Scientists (nec)

-

Automotive Heavy Mechanic (Agricultural)

-

-

Automotive

-

All Automotive

Select sub classifications-

Automotive Electrician

-

Motor Vehicle Parts and Accessories Fitter

-

Motor Vehicle or Caravan Salesperson

-

Panelbeater

-

Motor Vehicle Parts Interpreter

-

Vehicle Body Builder

-

Vehicle Trimmer

-

Vehicle Painter

-

Motor Mechanic (General)

-

Diesel Motor Mechanic

-

Motorcycle Mechanic

-

Small Engine Mechanic

-

Workshop/Service Centre Manager

-

Workshop Manager/Leading Hand

-

Fleet Manager

-

Railway Station Manager

-

Transport Company Manager

-

Others

-

-

Engineering

-

All Engineering

Select sub classifications-

Engineering Manager

-

Chemical Engineer

-

Materials Engineer

-

Civil Engineer

-

Geotechnical Engineer

-

Quantity Surveyor

-

Structural Engineer

-

Transport Engineer

-

Electrical Engineer

-

Electronics Engineer

-

Industrial Engineer

-

Mechanical Engineer

-

Production or Plant Engineer

-

Mining Engineer (excluding Petroleum)

-

Petroleum engineer

-

Aeronautical Engineer

-

Agricultural Engineer

-

Biomedical Engineer

-

Engineering Technologist

-

Environmental Engineer

-

Naval Architect

-

Engineering Professionals (nec)

-

Telecommunications Engineer

-

Telecommunications Network Engineer

-

Civil Engineering Technician

-

Civil Engineering Draftsperson

-

Electrical Engineering Technician

-

Electrical Engineering Draftsperson

-

Electronic Engineering Technician

-

Electronic Engineering Draftsperson

-

Mechanical Engineering Technician

-

Mechanical Engineering Draftsperson

-

Telecommunications Field Engineer

-

Telecommunications Network Planner

-

Telecommunications Technical Officer or Technologist

-

Architectural Draftsperson

-

Building Associate

-

Building Inspector

-

Construction Estimator

-

Plumbing Inspector

-

Surveying or Spatial Science Technician

-

Architectural, Building & Surveying Technicians (nec)

-

Safety Inspector

-

Maintenance Planner

-

Metallurgical or Materials Technician

-

Mine Deputy

-

Building and Engineering Technicians nec

-

Aeroplane Pilot

-

Air Traffic Controller

-

Flying Instructor

-

Helicopter Pilot

-

Air Transport Professionals nec

-

Master Fisher

-

Ship's Engineer

-

Ship's Master

-

Ship's Officer

-

Ship's Surveyor

-

Marine Transport Professionals nec

-

Architect

-

Landscape Architect

-

Surveyor

-

Cartographer

-

Other Spatial Scientist

-

Industrial Designer

-

Urban and Regional Planner

-

Software Engineer

-

Computer Network & Systems Engineer

-

ICT Quality Assurance Engineer

-

ICT Support Engineer

-

ICT Systems Test Engineer

-

ICT Support and Test Engineers (nec)

-

Aircraft Maintenance Engineer (Avionics)

-

Aircraft Maintenance Engineer (Mechanical)

-

Aircraft Maintenance Engineer (Structures)

-

Others

-

-

Healthcare & Medical

-

All Healthcare & Medical

Select sub classifications-

Registered Nurse (Aged Care)

-

Registered Nurse (Child & Family Health)

-

Registered Nurse (Community Health)

-

Registered Nurse (Critical Care & Emergency)

-

Registered Nurse (Developmental Disability)

-

Registered Nurse (Disability & Rehabilitation)

-

Registered Nurse (Medical)

-

Registered Nurse (Medical Practice)

-

Registered Nurse (Mental Health)

-

Registered Nurse (Perioperative)

-

Registered Nurse (Surgical)

-

Registered Nurse (Paediatrics)

-

Registered Nurses (nec)

-

MIDWIFE

-

Nurse Practitioner

-

General Practitioner

-

Resident Medical Officer

-

Anaesthetist

-

Specialist Physician (General Medicine)

-

Cardiologist

-

Clinical Haematologist

-

Medical Oncologist

-

Endocrinologist

-

Gastroenterologist

-

Intensive Care Specialist

-

Neurologist

-

Paediatrician

-

Renal Medicine Specialist

-

Rheumatologist

-

Thoracic Medicine Specialist

-

Specialist Physicians nec

-

Psychiatrist

-

Surgeon (General)

-

Cardiothoracic Surgeon

-

Neurosurgeon

-

Orthopaedic Surgeon

-

Otorhinolaryngologist

-

Paediatric Surgeon

-

Plastic and Reconstructive Surgeon

-

Urologist

-

Vascular Surgeon

-

Dermatologist

-

Emergency Medicine Specialist

-

Obstetrician and Gynaecologist

-

Ophthalmologist

-

Pathologist

-

Diagnostic and Interventional Radiologist

-

Radiation Oncologist

-

Medical Practitioners nec

-

Medical Diagnostic Radiographer

-

Medical Radiation Therapist

-

Nuclear Medicine Technologist

-

Sonographer

-

Optometrist

-

ORTHOPTIST

-

Dietitians

-

Environmental Health Officer

-

Occupational Health and Safety Adviser

-

Hospital Pharmacist

-

Industrial Pharmacist

-

Retail Pharmacist

-

Health Promotion Officer

-

Orthotist or Prosthetist

-

Health Diagnostic and Promotion Professionals nec

-

Chiropractors

-

Osteopaths

-

Acupuncturist

-

Homeopath

-

Naturopath

-

Traditional Chinese Medicine Practitioner

-

Complementary Health Therapist nec

-

Dental Specialist

-

Dentist

-

Occupational Therapist

-

Physiotherapist

-

Podiatrist

-

Audiologist

-

Speech Pathologist

-

Nurse Educator

-

Nurse Researcher

-

Nurse Manager

-

Medical Administrator

-

Nursing Clinical Director

-

Primary Health Organisation Manager

-

Welfare Centre Manager

-

Health And Welfare Services Managers (nec)

-

Enrolled Nurse

-

Mothercraft Nurse

-

Ambulance Officer

-

Intensive Care Ambulance Paramedic

-

Dental Hygienist

-

Dental Prosthetist

-

Dental Technician

-

Dental Therapist

-

Diversional Therapist

-

Aboriginal and Torres Strait Island Health Worker

-

Massage Therapist

-

Community Worker

-

Disabilities Services Officer

-

Family Support Worker

-

Parole or Probation Officer

-

Residential Care Officer

-

Youth Worker

-

Anaesthetic Technician

-

Cardiac Technician

-

Medical Laboratory Technician

-

Operating Theatre Technician

-

PHARMACY TECHNICIAN

-

Pathology Collector

-

Medical Technicians (nec)

-

Other

-

-

IT

-

All IT

Select sub classifications-

Chief Information Officer

-

ICT Project Manager***

-

ICT Managers (nec)

-

ICT Trainer

-

ICT Business Analyst

-

Systems Analyst

-

Multimedia Specialist

-

Web Developer***

-

Analyst Programmer

-

Developer / Programmer

-

Software Engineer

-

Software Tester

-

Software & Applications Programmers (nec)

-

Database Administrator

-

ICT Security Specialist

-

Systems Administrator

-

Computer Network & Systems Engineer

-

Network Administrator

-

Network Analyst

-

ICT Quality Assurance Engineer

-

ICT Support Engineer

-

ICT Systems Test Engineer

-

ICT Support and Test Engineers (nec)

-

Web Administrator

-

ICT Account Manager

-

ICT Business Development Manager

-

ICT Sales Representative

-

Multimedia Designer

-

Graphic Designer

-

Illustrator

-

Web Designer

-

Other

-

-

Scientific

-

All Scientific

Select sub classifications-

Conservation Officer

-

Environmental Consultant

-

Environmental Research Scientist

-

Park Ranger

-

Environmental Scientists (nec)

-

Anatomist or Physiologist

-

Biochemist

-

Biotechnologist

-

Botanist

-

Marine Biologist

-

Microbiologist

-

Zoologist

-

Life scientists (nec)

-

Life scientist (General)

-

Chemistry Technician

-

Earth Science Technician

-

Life Science Technician

-

School Laboratory Technician

-

Science Technicians (nec)

-

Medical Laboratory Scientist

-

Chemist

-

Food Technologist

-

Wine Maker

-

Geologist

-

Geophysicist

-

Agriculture Scientist

-

Chemical Engineer

-

Laboratory Manager

-

Natural and Physical Science Professionals nec

-

Nutritionist

-

Pathology Collector

-

Quality Assurance Manager

-

Sales Representative - Medical and Pharmaceutical

-

Veterinarian

-

Others

-

Hospital Pharmacist

-

Industrial Pharmacist

-

Retail Pharmacist

-

-

Trade

-

All Trade

Select sub classifications-

Airconditioning and Mechanical Services Plumber

-

Airconditioning and Refrigeration Mechanic

-

Aircraft Maintenance Engineer (Avionics)

-

Aircraft Maintenance Engineer (Mechanical)

-

Aircraft Maintenance Engineer (Structures)

-

Apparel Cutter

-

Baker

-

Pastrycook

-

Blacksmith

-

Boat Builder and Repairer

-

Bricklayer

-

Broadcast Transmitter Operator

-

Business Machine Mechanic

-

Butchers and Smallgoods Maker

-

Cabinetmaker

-

Cabler (Data and Telecommunications)

-

Camera Operator (Film, Television or Video)

-

Canvas Goods Fabricator

-

Carpenter

-

Carpenter and Joiner

-

Chef

-

Chemical Plant Operator

-

Clothing Trades Worker (nec)

-

Clothing Patternmaker

-

Communications Operator

-

Cook

-

Drainer

-

Dressmaker or Tailor

-

Electrical Linesworker

-

Electrician (General)

-

Electrician (Special Class)

-

Electronic Equipment Trades Worker

-

Electronic Instrument Trades Worker (General)

-

Electronic Instrument Trades Worker (Special Class)

-

Electroplater

-

Engineering Patternmaker

-

Engraver

-

Farrier

-

Fibrous Plasterer

-

Fire Protection Equipment Technician

-

Fitter (General)

-

Fitter and Turner

-

Fitter-Welder

-

Floor Finisher

-

Furniture Finisher

-

Gallery or Museum Technician

-

Gas or Petroleum Operator

-

Gasfitter

-

Glazier

-

Graphic Pre-press Trades Worker

-

Gunsmith

-

Hairdresser

-

Jeweller

-

Joiner

-

Leather Goods Maker

-

Lift Mechanic

-

Light Technician

-

Locksmith

-

Make up Artist

-

Metal Casting Trades Worker

-

Metal Fabricator

-

Metal Fitters and Machinists nec

-

Metal Machinist (First Class)

-

Metal Polisher

-

Musical Instrument Maker or Repairer

-

Optical Dispenser

-

Optical Mechanic

-

Painting Trades Workers

-

Pastry cook

-

Performing Arts Technician (nec)

-

Picture Framer

-

Plastics Technician

-

Plumber (General)

-

Power Generation Plant Operator

-

Precision Instrument Maker and Repairer

-

Pressure Welder

-

Print Finisher

-

Printing Machinist

-

Roof Plumber

-

Roof Tiler

-

Sail Maker

-

Saw Maker and Repairer

-

Screen Printer

-

Sheetmetal Trades Worker

-

Shipwright

-

Shoemaker

-

Signwriter

-

Small Offset Printer

-

Solid Plasterer

-

Sound Technician

-

Stonemason

-

Technical Cable Jointer

-

Technicians and Trades Workers nec

-

Telecommunications Cable Jointer

-

Telecommunications Linesworker

-

Telecommunications Technician

-

Television Equipment Operator

-

Textile, Clothing and Footwear Mechanic

-

Toolmaker

-

Upholsterer

-

Wall and Floor Tiler

-

Watch and Clock Maker and Repairer

-

Welder (First Class)

-

Wood Machinist

-

Wood Machinists and Other Wood Trades Workers nec

-

Wood Turner

-

Fashion Designer

-

Jewellery Designer

-

Interior Designer

-

Other

-

REFINE RESULTS

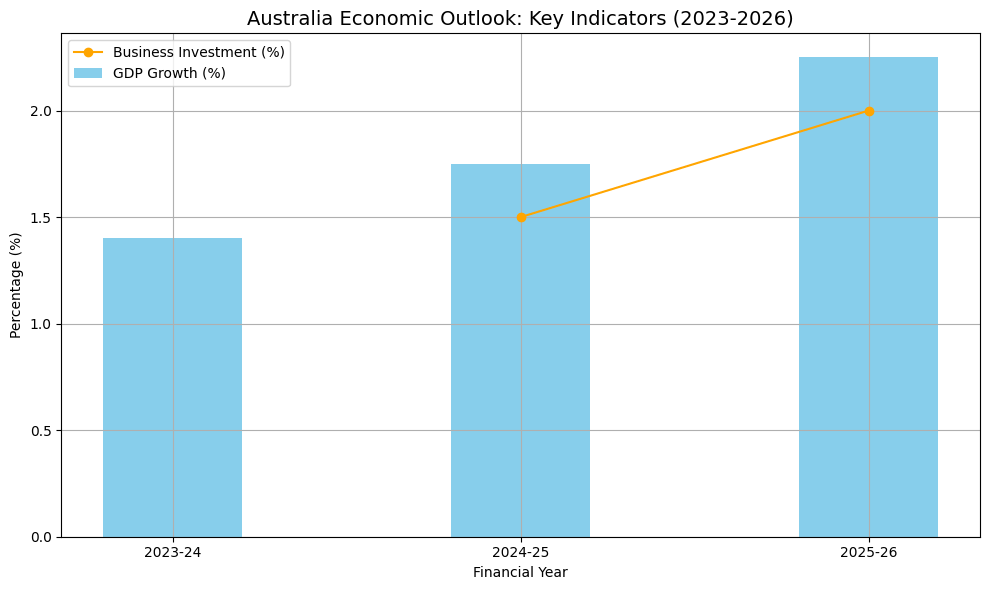

Australia’s economic trajectory for the 2024–25 financial year signals a cautious yet steady recovery. Real GDP growth is forecast to rise to 1.5%, improving from 1.4% in 2023–24, and is projected to reach 2.25% in 2025–26. This recovery will be driven primarily by a rebound in household consumption, boosted by government cost-of-living tax cuts and easing inflation. However, a fragile global environment, ongoing geopolitical tensions, and trade volatility continue to pose substantial risks.

Key Economic Indicators and Trends

GDP Growth

- Real GDP is projected to grow from 1.4% in 2023–24 to 1.5% in 2024–25 and 2.25% in 2025–26.

- Compared to other Western economies, Australia’s growth is modest but stable. For instance, the U.S. is facing downgraded growth prospects due to new tariffs, and Europe’s recovery hinges on fiscal reforms.

Inflation

- Inflation has moderated significantly from its 2022 peak.

- The Consumer Price Index (CPI) is forecast at 2.5% in 2024–25, returning to the Reserve Bank of Australia’s target band of 2–3%.

- However, inflation may temporarily rise due to the expiry of government energy rebates.

Household Tax Cuts

- The Stage 3 tax cuts are expected to lift real household disposable income, supporting consumption.

- These tax cuts are central to the Albanese government’s cost-of-living relief and may also influence voter sentiment heading into the next election.

- More detail on the specific tax thresholds and brackets would be beneficial in an appendix or visual, such as a tax comparison table.

Household Consumption

- Household spending is expected to recover gradually.

- This recovery is tied to wage growth (WPI forecast at 3% in 2024–25) and improved employment, particularly in the market sector.

- However, weak consumer confidence due to global trade tensions may weigh on this rebound.

Business Investment

- Business investment remains strong but is expected to moderate to 1.5% in 2024–25 and 2% in 2025–26, still at some of the highest levels since the 2010s.

- Investment in non-dwelling construction is slowing as the pipeline of projects contracts.

- A rebound in dwelling investment is anticipated from 2025–26 due to easing supply-side constraints and lower financing costs.

Global Headwinds and Risks

Tariff Wars and Geopolitical Tensions

- In April 2025, the U.S. imposed 10–50% tariffs on imports, prompting China’s retaliatory 34% tariffs on U.S. goods.

- These moves disrupt global trade and are expected to weigh on international investment, supply chains, and Australian exports—especially via indirect exposure through China.

- The effects could weaken business and consumer confidence in Australia.

Broader Geopolitical Instability

- Conflicts in Ukraine, Israel–Palestine, and tensions surrounding Taiwan and the South China Sea remain sources of global economic instability.

- These could further disrupt global supply chains and energy markets, feeding into inflation and commodity volatility.

Commodity and Currency Volatility

- Commodity prices, including oil, have dropped sharply. If sustained, this could reduce nominal GDP and government revenue.

- A weaker Australian dollar may drive up the cost of imports, putting upward pressure on inflation even as domestic demand remains subdued.

Labour Market and Wages

- Unemployment is expected to tick up to 4.25% by mid-2025, from 4% currently.

- Real wages grew 0.8% in 2024, and are forecast to grow 0.5% in 2024–25 and 0.25% in 2025–26.

- Employment gains have largely been driven by the non-market sector; a shift toward market sector growth is expected as the economy picks up.

Migration and Demographics

- Net Overseas Migration (NOM) continues to decline, driven by fewer arrivals and an expected rise in departures as pandemic-era visas expire.

- This trend could impact labour supply, housing demand, and overall economic growth if not managed effectively.

Conclusion

Australia’s 2024–25 economic outlook points to a fragile yet promising recovery, supported by domestic fiscal policy and a stabilising inflation environment. However, global uncertainty, rising tariffs, and geopolitical tensions pose significant downside risks. Policymakers must remain agile, particularly around trade, migration, and labour market support, to maintain stability and encourage sustained growth.

Related News

National Press Club – Address by the Hon Tony Burke MP

National Press Club – Address by the Hon Tony Burke MP Canberra, ACT, Oct 15, 2025 Attended by Fred Molloy, Registered Migration Agent. On Wed 15th October I attended the Honorable Minister Tony Burkes speech at the National Press Club in Canberra. The Minister has vast portfolio of Home Affairs, The Arts, Cyber…

Shaping the Future of Australia’s Workforce with Jobs and Skills Australia

Shaping the Future of Australia’s Workforce with Jobs and Skills Australia Australia is at a pivotal moment where the need for a skilled and adaptable workforce is more crucial than ever. Jobs and Skills Australia, an influential body in workforce development, recognises that collaboration with stakeholders is essential to effectively address the country’s present and…

TSMIT increases on July 1, 2025

TSMIT increases on July 1, 2025 Australian employers and skilled migrants should prepare for upcoming changes to visa income thresholds, with a 4.6% increase taking effect from 1 July 2025. Known as the TSMIT, which is the acronym for the Temporary Skilled Migration Income Threshold, this adjustment reflects changes in Australia’s Average Weekly Ordinary Time…